Here are some notes on how to handle Accounting Principals while also using Design Patterns to solve what appears to be a simple problem. Accounting Principals are the fundamental components to accounting. These principals were invented or conceived long before Computers. Computers were invented to increase accuracy and reduce labor costs among other things. I mention these timelines because they help explain why we (developers), design things in a specific way. We do this so they (accounting) can see the information in a way that’s meaningful in their field of study. If it weren’t for Accounting Principals our RDMS Schemas would probably look very different.

Accounting Principals

First, what we we looking to accomplish. At the end of the day we (developers & accountants) are look to generate Financial Statements with the information gather thru a period of time. Financial Statements consist are comprised of four things. Income Statement, Retained Earnings, Balance Sheet & Cashflow Statement

Income Statement – Shows the Revenue, Expenses, and Net Income or Loss of a business. Also known as a Profit & Loss Statement.

Retained Earnings – A Financial Statement showing how much earnings a company has kept since inception. Retained Earnings are profits not paid to Shareholders as Dividends.

Balance Sheet – A statement of Assets, Liabilities and Equity at a particular point in time.

Cashflow Statement – A statement of Money In & Money Out over a period of time. The statement explains how the money arrived at each account.

The order I have listed the financial statements is important. You can’t calculate the Balance Sheet without the Retained Earnings, and you can’t calculate Retained Earnings without an Income Statement.

Financial Accounting Elements

These elements are the building blocks of all accounting systems. The elements help us organize our financial information in a way that it can be reported and acted upon. There are 9 elements.

Assets – Refers to a resource owned and controlled by the company as a results of past transactions or events.

Liabilities – Are claims by other parties against and companies asset

Equity – Is the capital that is left after all liabilities are settled.

Revenues – The amount earned from the company’s ordinary business.

Expenses – Obligations that decrease assets or increase liability resulting in a decrease in equity.

Gains – Revenue from other activities such as the sale of equipment, revenue from the sale of short-term investments and other gains.

Losses – Is an excess of expenses over revenues for a given period of time.

Other Comprehensive Income (OCI) – Are revenues, expenses, gains or losses that have yet to be realized and are excluded from Net Income on an Income Statement.

Dividend – A companies obligation to shareholders and inventors. This number affects the Balance Sheet and Retained Earnings.

Relating Principals & Elements

Income Statement

Elements:

- Revenue

- Expenses

- Gains

- Losses

Produces:

Net Income

Retained Earnings

Elements:

- Net Income

- Dividend

Produces:

Retained Earnings

Balance Sheet

Elements:

- Assets

- Liabilities

- Equity

Produces:

Rate of Return / Capital Structure

Cashflow Statement

Elements:

- Revenue

- Expenses

- Gains

- Losses

Produces:

Inflows and Outflows of OIF (Operations, Investments & Finance)

Accounting Equation

The accounting equation is the foundation for double entry accounting. There are two points I want to make here. First, All Debits are on the left and all Credits are on the right. This is true for T Accounts, or any other financial statement. The accounting equation is fundamental in producing a companies Balance Sheet.

[Debits] [ Credits ]

Assets = Liabilities + Equities

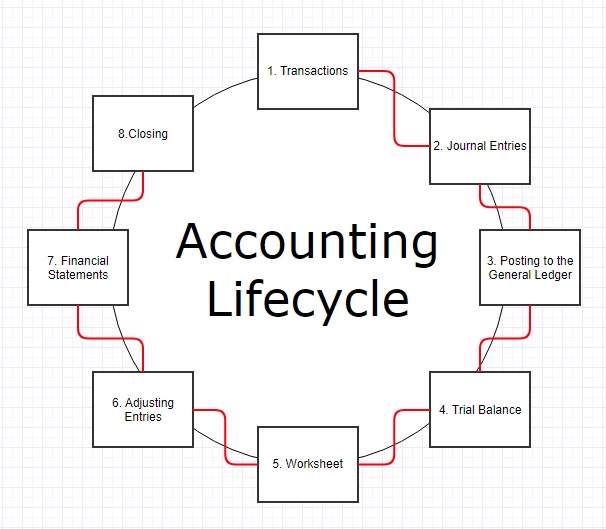

Accounting Lifecycle

The Accounting Lifecycle is the process of recording and processing all financial transactions within a company.

1. Transaction

Without a transactions we have nothing to account for. Transactions can include Invoices, Purchase Orders, Interest Earned, Debt Payoff or any other type of financial movement.

2. Journal Entries

Each transaction will have at minimum two Journal Entries and often times more. One will be a Credit and the other Debit. The important principal with double entry accounting is that the debits and credit match.

3. Posting to the General Ledger

Journal Entries are posted to the General Ledger with their respective accounts.

4. Trial Balance

A balance for accounts at the end of a given financial period. These periods can be Yearly, Quarterly or Monthly.

5. Worksheet

If the Trial Balance Debits and Credits do not match the error must be found. A worksheet is created to track the changes needed to make Accounts balance.

6. Adjusting Entries

Adjusting Entries are entered at the end the period to handle accruals, deferrals and estimates. Adjusting entries occur when a transaction is recognized as having occurred but has not been filled financially.

7. Financial Statements

Back to the top of this page. Now what our journal is complete we can create our Financial Documents such as Income Statement, Retained Earnings, Balance Sheet and Cashflow Statement.

8. Closing

The revenue and expense accounts are closed and zeroed in preparation for the next accounting cycle. Revenue and Expense accounts are Income Statement accounts, which show performance for a specific period. Balance sheet accounts are not closed because they show the company’s financial position at a certain point in time.

This Blog Page is a work in Progress. Click here for Comp Sci Design Diagram